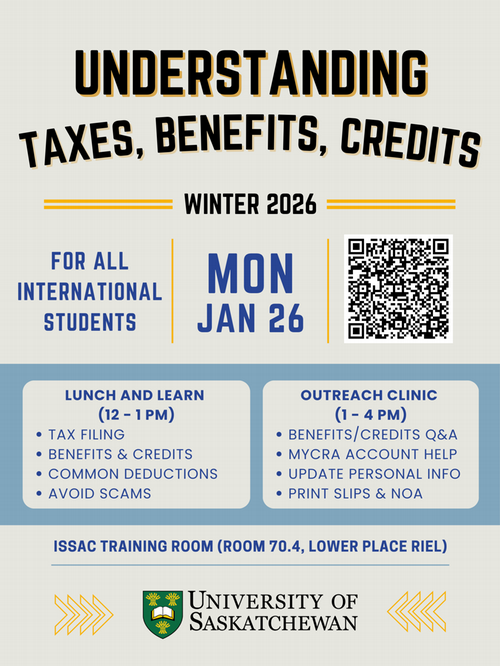

Understanding Taxes, Benefits, and Credits for International Students

All events International

Taxes do not have to be confusing. Join ISSAC for a session with the CRA to learn about tax responsibilities, benefits, credits, and student deductions, then get help at the outreach clinic.

Event Details

When:

Time: noon–4 pm

Location: ISSAC Training Room (Room 70.4, Lower Place Riel, 1 Campus Drive)

Join ISSAC for an in-person session with a Benefits Outreach Officer from the Canada Revenue Agency (CRA), designed specifically for international students.

From 12:00–1:00 PM, attend a Lunch and Learn presentation focused on key tax topics for students, including:

-

Your tax filing responsibilities in Canada

-

Benefits and credits you may be eligible to receive

-

Ways to file your taxes

-

Common tax deductions for students

-

How to recognize and avoid tax-related scams

From 1:00–4:00 PM, the CRA representative will host an outreach clinic, where students can receive one-on-one support with:

-

Benefits and credits questions

-

MyCRA account setup or access

-

Updating personal information such as address changes

-

Printing income slips, Notices of Assessment, and income and deductions summaries

Students who wish to receive support during the clinic must bring valid ID and their SIN.

This event is a great opportunity to learn the basics, ask questions, and prepare confidently for the upcoming tax season.